With Right Law Group, You’re Not Fighting This Alone

Let’s be real: facing criminal fraud charges is scary. The legalese, the looming court dates, the possibility of jail time… it’s enough to make anyone feel powerless.

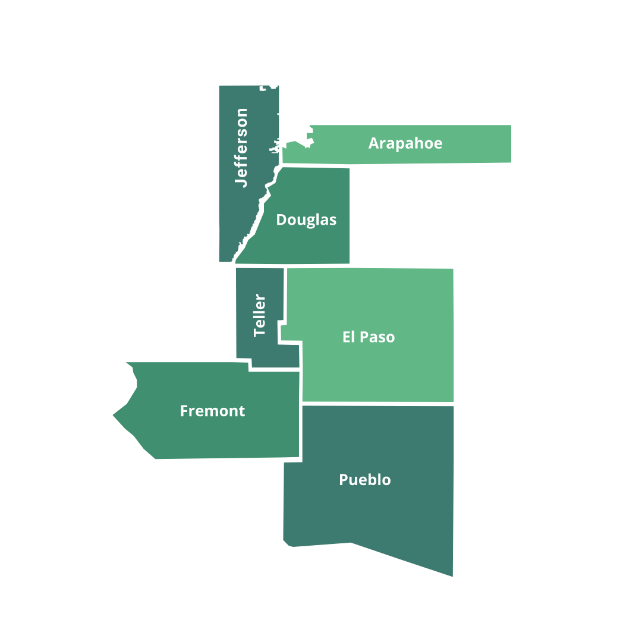

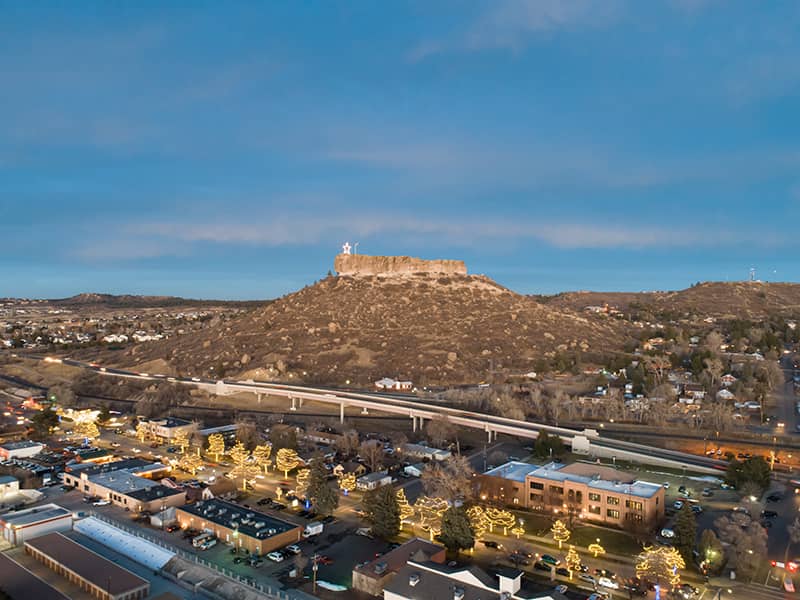

But take a deep breath. You’ve got an experienced legal team in your corner now. As Castle Rock credit card fraud lawyers, we’ve helped hundreds of clients in your shoes beat bogus allegations and avoid life-altering convictions. You have rights under the law. And we’re here to fight for them.

We get it, that frightening call from the cops, the confusing court documents – it’s a lot. But we’re going to make this make sense. No more feeling lost and alone. We’re your guides through this mess.

And together, we’re going to take back control.

Here’s a quick breakdown of potential penalties you could be facing:

| Value of Credit Card Fraud | Class of Criminal Offense | Penalties |

|---|---|---|

| Less than $300 | Petty Offense | Up to 10 days in jail and/or a fine of up to $300 |

| $300 or more but less than $1,000 | Class 2 Misdemeanor | Up to 120 days in jail and/or a fine of up to $750 |

| $1,000 or more but less than $2,000 | Class 1 Misdemeanor | Up to 364 days in jail and/or a fine of up to $1,000 |

| $2,000 or more but less than $5,000 | Class 6 Felony | 12 to 18 months in jail and/or a fine of up to $100,000 |

| $5,000 or more but less than $20,000 | Class 5 Felony | 1 to 3 years in prison and/or a fine of up to $100,000 |

| $20,000 or more but less than $100,000 | Class 4 Felony | 2 to 6 years in prison and/or a fine of up to $500,000 |

| $100,000 or more but less than $1 million | Class 3 Felony | 4 to 12 years in prison and/or a fine of up to $750,000 |

| $1 million or more | Class 2 Felony | 8 to 24 years in prison and/or a fine of up to $1,000,000 |

See, the cops think this is simple – you used a card, must be fraud, case closed. But we don’t back down that easy. We’re going to dig into their so-called “evidence” until we strike gold — that shred of doubt that wins cases.

Picture this: some hacker in Hong Kong steals your card info. Starts buying watches and jets in your name. But you haven’t used that card in months. Still, the cops blame you. Why? Your name’s on it.

We call that lazy police work. Jumping to conclusions instead of doing real detective work. You know what we call it? Reasonable doubt. And we expose questionable cases like this all the time.

Let’s break down how we win. It starts by poking holes. Cops cut corners when they’re under pressure to close cases fast. We exploit those missteps. Evidence gathered improperly? Tossed. Witness seeming sketchy? We shred their testimony in court.

Here’s the major key alert of credit card fraud cases – the burden of proof is on the prosecution. And we capitalize at every single turn.

That’s just defense. We play offense too. Say you let your friend borrow your card for gas. But he went shopping instead. We track him down, subpoena receipts, paint the real story to highlight your innocence.

Here’s the truth. The system is broken. Good people get chewed up every day. We didn’t become lawyers to prop up a crooked system. We’re going to defend you against these bogus charges relentlessly until justice wins.

Here’s something they won’t tell you – most fraud cases end in plea deals. Scared people getting pressured into convictions. Well we don’t take bad deals. We’d rather duke it out in court than bow down to injustice.

Credit Card Fraud FAQs

For a first time minor offense under $500, penalties may include fines, probation or community service. More serious first offenses can still face felony charges.

Yes, any reported unauthorized credit card use or theft will be investigated regardless of amount. Charges and penalties vary based on total loss.

Common methods include victim account monitoring, bank fraud analysis, retailer fraud screening, device tracing and digital forensics analysis.

Felony credit card theft or fraud usually involves losses over $1,000, multiple victims, or highly organized criminal operations.

Skimming devices, phishing scams, identity theft access, fake merchant accounts, manipulating card readers, fraudulent applications using stolen data.

Laws prohibiting unauthorized or fraudulent use of credit cards include identity theft, unlawful use of a financial device, computer crime, and forgery statutes.

Using another person’s credit card without their consent is still unlawful, even for family. Permission is required for legal use.